Related Documents

Rouyn Noranda, Q.C., May 8, 2023 - Granada Gold Mine Inc. (TSXV: GGM) (OTC: GBBFF) (Frankfurt: B6D) (the “Company” or “Granada”) is pleased to announce ALS GoldSpot has completed its first round of deliverables as part of its approach to identifying highly prospective areas for new discoveries at existing gold deposits. The Company expects the second round to produce new machine learning drill targets for both the main Granada Block and the Aukeko block to the east.

Highlights:

- Four medium-high risk holes for 3,100m of drilling have been identified in addition to the 9 zones where there could be significant impact to the resource with some larger step outs.

- LiDAR Processing and Derivative Products ultimately used to develop a new Lineament Map of the entire Granada property.

- Geophysical Inversions of Regional Surveys and Local Drone Surveys have been created.

- Traditional Targeting focusing on 9 sectors prioritized by depth, grade of nearest mineralized interval, and potential for resource expansion. Total of 85,215m of drilling identified with 12,700m in the highest priority.

With the combination of multiple LiDAR products, a lineament map of the entire property was created. This data is to be used in both the 2D property geology map and the 3D geological model.

An Updated Property Geology Map was created, using the historical maps, lineament data, and additional drill data from previous Granada drill programs to fill in any gaps in the data.

Geophysical Inversions of Regional Surveys and Local Drone Surveys were created and will be important in the next steps of targeting to find drill targets for gold mineralization based on this Machine Learning (ML) process.

The new 3-D geological model started with a Fault model, grouped into 3 orientations followed by a feldspar porphyry dyke model, and finally, a sedimentary rock model. A mathematical model using gold intersections over 1 g/t was generated and trends around lithological contacts and faults were characterized. Thirty-Six (36) wireframes around these faults and contacts were generated to define drill targets.

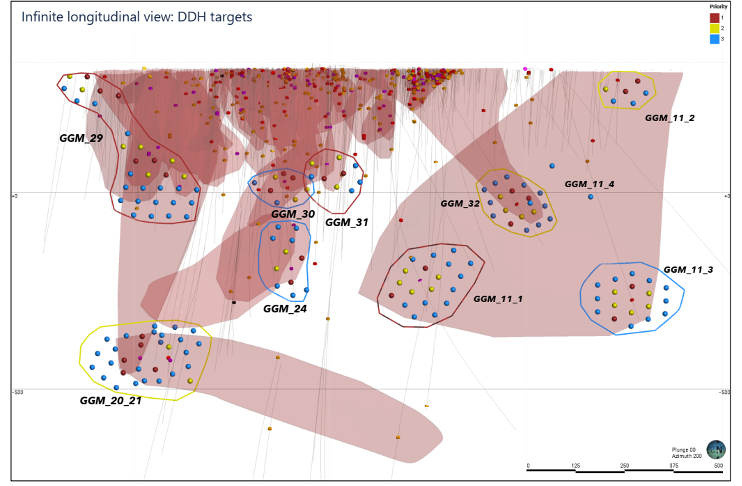

Nine (9) sectors were identified for potential drill targets (see Figure 1: 9 drill target sectors). Each sector was prioritized: high (1 - red), medium (2 - yellow), and low (3 - blue). Priority of each sector is based on the average depth, the grade of the nearest mineralized interval, and the potential for resource expansion. Within each sector, there are drillhole targets with the same priority classification. High being the first drilling and low being the later, definition drilling. The spacing ranges from 25m (indicated potential) to 75-100m (inferred potential). Of the total 85,215m of proposed drilling, the highest priority drillholes account for 12,700m, the medium priority drillholes account for 16,925m of drilling and the remaining is 55,590m.

Figure 1: 9 drill target sectors

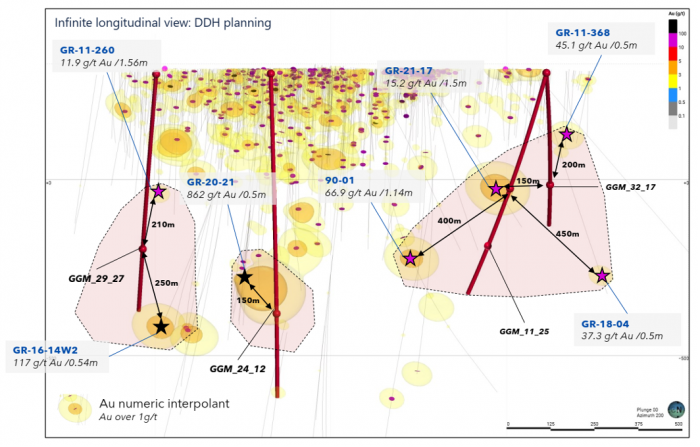

In addition to nine sectors, 4 drill holes have been proposed as expansion drilling. These four holes are designed to assess the extension of multiple zones at the Granada site. They represent a medium-high risk for 3,100m of drilling but have the potential to significantly impact the resources. (See Figure 2: 3100m of proposed expansion drilling)

The company anticipates the second round of more robust results to contain new ML-defined drill targets for the main Granada block and will use the already well-defined mineralization characteristics from the data-dense Granada deposit to generate new and distinct targets at the Aukeko block to the east.

Figure 2: 3100m of proposed expansion drilling

Frank J. Basa, P.Eng. commented, President and CEO commented, “Now that ALS GoldSpot is familiar with the dataset, we are excited to see what ML targets will be generated in the next round.”

Qualified person

The technical information in this news release has been reviewed and approved by Claude Duplessis, P.Eng., GoldMinds Geoservices Inc., a member of the Québec Order of Engineers, and is a qualified person in accordance with the National Instrument 43-101 standards.

About Granada Gold Mine Inc.

Granada Gold Mine Inc. continues to develop and explore its 100%-owned Granada Gold Property near

Rouyn-Noranda, Quebec, and is adjacent to the prolific Cadillac Break. The Company owns 14.73 square kilometers of land in a combination of mining leases and claims. The Company is currently undergoing a large drill program with 30,000 meters (2020-2021) out of 120,000 meters complete. The drills are currently paused to provide the technical team the necessary time to evaluate and assimilate existing data.

The Granada Shear Zone and the South Shear Zone contain, based on historical detailed mapping as well as from current and historical drilling, up to twenty-two mineralized structures trending east-west over five and a half kilometers. Three of these structures were mined historically from four shafts and three open pits. Historical underground grades were 8 to 10 grams per tonne gold from two shafts down to 236 meters and 498 meters with open pit grades from 3.5 to 5 grams per tonne gold.

Mineral Resource Estimate

The mineral resources of the PFS are inclusive of the 2022 Mineral resource update. On August 20, 2022 the Company released an updated NI 43-101 technical report supporting the resource estimate update for the Granada Gold project (Please see July 6, 2022 news release) reporting that the Granada deposit contains an updated mineral resource, at a base case cut-off grade of 0.55 grams per tonne gold for pit constrained mineral resources within a conceptual pit shell and at a base case cut-off grade of 2.5 grams per tonne for underground mineral resources within reasonably mineable volumes, of 543,000 ounces of gold (8,220,000 tonnes at an average grade of 2.05 grams per tonne gold in the Measured and Indicated category, and 456,000 ounces of gold (3,010,000 tonnes at an average grade of 4.71 grams per tonne) in the Inferred category. Please see Table 1 below for full details. Report reference: Granada Gold Project Mineral Resource Estimate Update, Rouyn-Noranda, Quebec, Canada authored by Yann Camus, P.Eng. and Maxime Dupéré, B.Sc., P.Geo., SGS Canada Inc. dated August 20th, 2022 and with an effective date of June 23rd, 2022.

Table 1: Mineral Resource Estimate Showing Tonnes, Average Grade, and Gold Ounces

Cut-Off (g/t Au) | Classification | Type | Tonnes | Au (g/t) | Gold Ounces |

0.55 / 2.5 | Measured1 | InPit+UG | 4,900,000 | 1.70 | 269,000 |

Indicated | InPit+UG | 3,320,000 | 2.57 | 274,000 | |

Measured & Indicated | InPit+UG | 8,220,000 | 2.05 | 543,000 | |

Inferred | InPit+UG | 3,010,000 | 4.71 | 456,000 |

(1) The 1930-1935 production was removed from these numbers (164,816 tonnes at 9.7 g/t Au / 51,400 ounces Au).

(2) The Independent QP for this resources statement is Yann Camus, P.Eng., SGS Canada Inc.

(3) The effective date is June 23rd, 2022.

(4) CIM (2014) definitions were followed for Mineral Resources.

(5) Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

(6) No economic evaluation of the resources has been produced.

(7) All figures are rounded to reflect the relative accuracy of the estimate. Totals may not add due to rounding

(8) Composites have been capped where appropriate. The 2.5 m composites were capped at 21 g/t Au in the thin rich veins and at 7 g/t Au in the low-grade volumes.

(9) Cut-off grades are based on a gold price of US$1,700 per ounce, a foreign exchange rate of US$0.78 for CA$1, a processing gold recovery of 93%.

(10) Pit constrained mineral resources are reported at a cut-off grade of 0.55 g/t Au within a conceptual pit shell

(11) Underground mineral resources are reported at a cut-off grade of 2.5 g/t Au within reasonably mineable volumes.

(12) A fixed specific gravity value of 2.78 g/cm3 was used to estimate the tonnage from block model volumes

(13) There are no mineral reserves on the Property.

(14) The deepest resources reported are at a depth of 990 m.

(15) SGS is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issues that could materially affect the mineral resource estimate.

(16) The results from the pit optimization are used solely for the purpose of testing the “reasonable prospects for economic extraction” by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in the preparation of a mineral resource statement and to select an appropriate resource reporting cut-off grade.

The property includes the former Granada Gold underground mine which produced more than 50,000 ounces of gold at 10 grams per tonne gold in the 1930’s from two shafts before a fire destroyed the surface buildings. In the 1990s, Granada Resources extracted a bulk sample (Pit #1) of 87,311 tonnes grading 5.17 g/t Au. They also extracted a bulk sample (Pit # 2) of 22,095 tonnes grading 3.46 g/t Au.

“Frank J. Basa”

Frank J. Basa, P. Eng.

Chief Executive Officer

For further information, Contact:

Frank J. Basa, P.Eng.

Chief Executive Officer

P: 416-625-2342

Or:

Wayne Cheveldayoff,

Corporate Communications

P: 416-710-2410

E: waynecheveldayoff@gmail.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements.